Rebate for Dynamic Glass

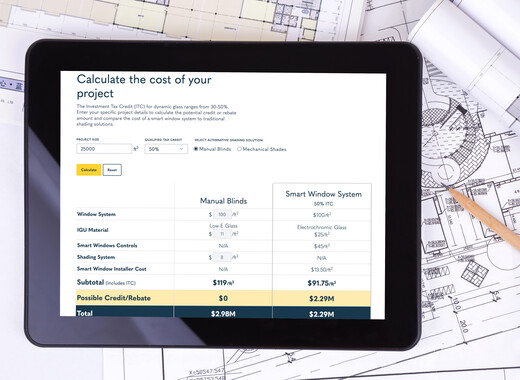

The Inflation Reduction Act added smart windows to the Investment Tax Credit (ITC). Building owners in the United States are eligible to receive a 30-50% tax credit or direct rebate on dynamic glass*.

Dynamic Glass & The Investment Tax Credit

Reduced Upfront Cost

Eligibility & Transferability

Tax-Exempt Entities

* The purpose of this information is to make you aware of some of the possibilities with respect to the Investment Tax Credit (ITC) so that you may work with your tax advisors to investigate your options. This information is not meant to be tax advice but merely a tool to help our customers who select SageGlass dynamic glass solutions to investigate options to receive an ITC. Please note, just the fact that you use SageGlass dynamic glass solutions may not entitle you to receive an ITC. You may have to demonstrate that your project satisfies all the required criteria. Please consult with your tax advisors if your project is eligible based on your specific project criteria.